GSTR1 Filling Help Guide

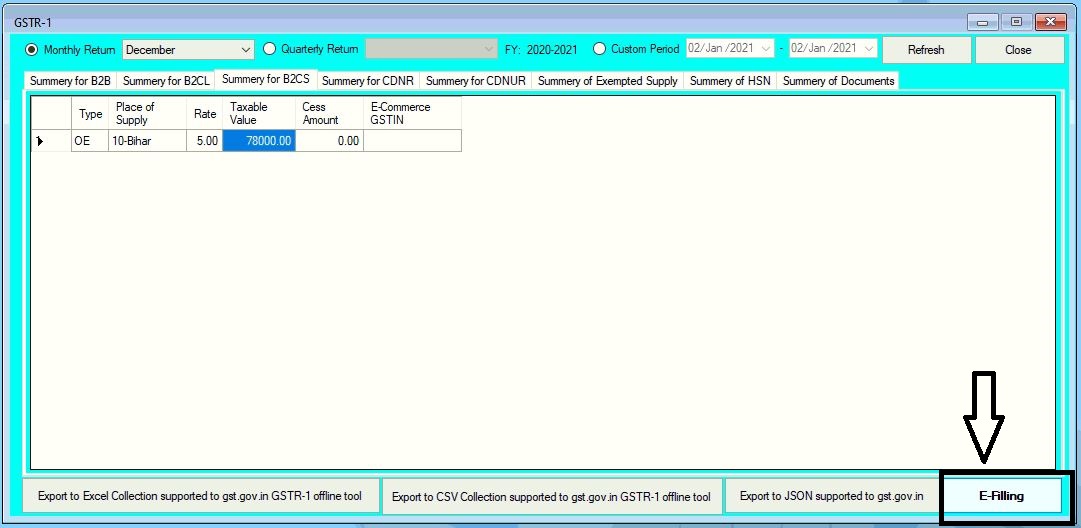

How to File GSTR1 in Chanakya ERP Without login GST Portal

- Select GST Return Option

- Choose "GSTR1"

B2CL invoice: An invoice is said to be B2CL invoice if i follows these criteria,

If the sales invoice is generated for the client who is from the different state (i.e. inter state) and the invoice value is more than Rs.2.5 lakhs then the invoice is said to be B2CL invoice.

If the Sales invoice is generated for the client who is from the same state (i.e. intra state) as of the supplier then the Sales invoice will fall under the category of B2CS

If the invoice value is less than Rs.2.5 lakhs, irrespective of the place of supply i.e. inter state or intra state the invoice will fall under the category of B2CS

CDNR: This sheet requires details of Debit / Credit Notes issued to: Registered Tax Payers for invoices reported in B2B.

CDNUR: This sheet requires details of Debit/Credit Notes issued to: Unregistered Tax Payers for Invoices reported in B2CL

Exempted Supply: supply of any goods or services or both which attracts nil rate of tax.

Summery of HSN: HSN is the unique code of each items in GST

- Click on "E-Filling" Button

wait for a second your status will be assigned in status and status should be "Processed" to continue to next step.

After assigning your status as Processed

- Step 3 Click on "Submit" Button

- Step 5 Click on Request EVC

- Click on "File GSTR1" Button

Comments

Post a Comment