Chanakya ERP Update Release 1.1.4.0

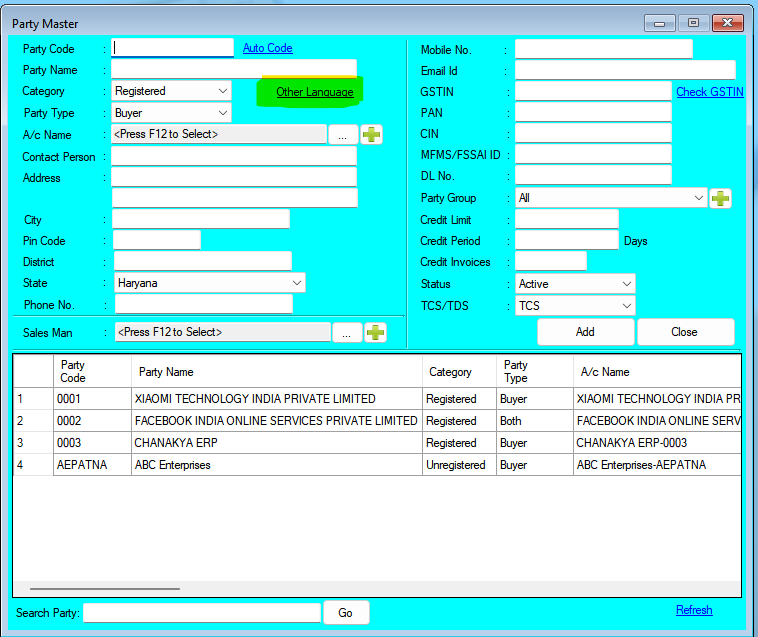

Updates Released in New Version of Chanakya ERP (1.1.4.0) Highlights Now Party (Buyer) Details on Invoice can be printed in your local language using Unicode Features in Chanakya ERP. How to use this feature. Enter Party Details in your local language like shown in below images. After Updating Details in Party Master. Chanakya ERP will automatically print party details in Invoice in your local language as shown in below image. And Many More Minor Updates and Enhancement For More Query/Support, Call us on +91 8447740155 Thank You !