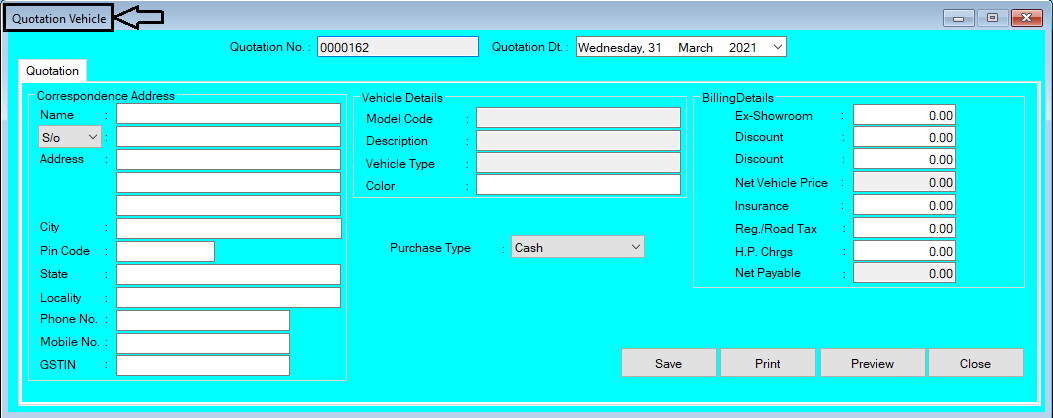

How to Create/Modify/Cancel Quotation of Vehicle Entry in Chanakya ERP Create Quotation Click on Inventory Vehicle Menu Click on Quotation A new window will popped up In Open Window You will find the Correspondence Address of Party/Customers , where you have to take the full details from Party/Customers to fill here in the Address Box, as shown in below image In Next Part you can Fetch the details of Vehicle from its Model Code , Description , Vehicle type , Color and Billing Details Will Auto fetch By Pressing "F12" key on "Model Code" , all Vehicle List will be Opened, Select the Vehicle from List, It's Details will be automatically fetched Here you can Manually Enter the Color and Some Billing details like Discount , Insurance Charge , Reg/Road Tax and H.P Charges , as shown in below image Select Purchase Type "Cash" or "Finance" , as shown in below image Click on "Save" Button to Save the Quotation "Print" ...