GST Credit Note Help Guide

How to Create/Modify/Cancel GST Credit Note in Chanakya ERP

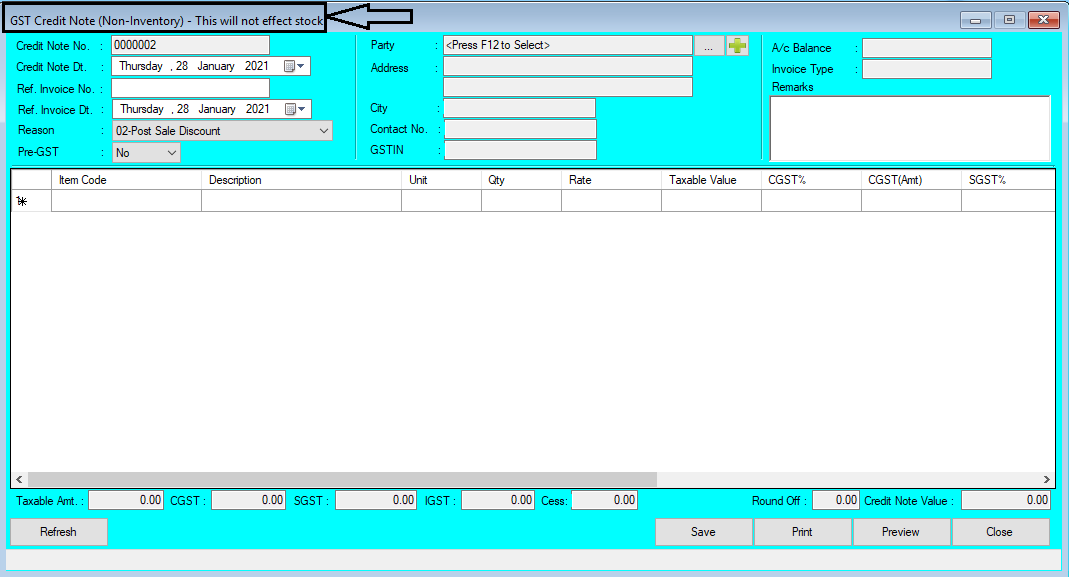

Create GST Credit Note

- Click on GST Credit Note in Inventory Menu to open GST Credit Note option (as shown in below image).

- Credit Note No. will be Created (Automatically & Manual Setting in Document Number Settings option)

- Select Credit Note Date on Clicking on Date Drop Down Box

- Enter Reference Invoice No. with Reference Invoice Date which Was Generated during Sales

- Select the Reason of GST Credit Note (Various Reason Available in Drop Down Box) from Drop Down List you can Select according to your Needs and Mention Pre-GST information in Yes or No.(Either Pre GST applied or Not)

- Press "F12" Key to open Party List and Select the Specific Party Details Whose GST Credit Note is to be Created

- You can also Click on Three dot (...) to View the Party List and Select it on Clicking it

- Click on Plus Sign (+) to Open Party Master where you can Create/Add New Party Details in Software, as shown in below image

- While Selecting Particular Party Details, Previous A/c Balance (Credit Or Debit) will be automatically Update in A/c balance Box

- Invoice Type will Depend on Party address (Intra or Inter State Invoice) and will Appear Automatically

- Remarks Box is to write Any Remarks regarding GST Credit Note, or For Particular Invoice, as shown in below image

- Click on Item Code and Enter Item Code (First Digit or Name of Item) and Press Enter Key to Open Item List Panel in which you can Select Item which you want to Add in GST Credit Note List

- Selected Item will Displayed with Item code and other details, Enter Quantity and Select Reason Type for which item is being Added as GST Credit Note, Credit Note Value will be Calculated automatically when Quantity entered

- Click on Save button to Save the GST Credit Note for Sales Return, as shown in below images

Modify GST Credit Note

- Press "F12" Key on Column of Credit Note No. to Open Previous Credit Note List in Modify Mode, as shown in below image

- Double Click or Select Particular GST Credit Note Number for Modification, Edit/Modify the Required Column and Click on Save Button to View the Changes, as shown in below image

- Press "F12" Key on Column of Credit Note No. to Open Previous Debit Note List, as shown in below image

- Double Click or Select Particular GST Credit Note Number and Open in Modify Mode, Edit/Modify the Required Column and Click on Save Button to View the Changes, as shown in below image

- Right-Click with your Mouse on Any Blank Area (Color Area) where you will get option for "Cancel Credit Note" as shown in below image

- After Clicking on "Cancel Credit Note" Button a New Pop-Up Window will open which will ask "Reason of Cancellation of GST Credit Note" you will have to provide Reason of Cancel/Delete in Message Box, If you have to Release GST Credit Note Serial Number then Select Check Box (By default Check Box is Selected), if not then Uncheck Check Box and then Click on "Cancel Credit Note" button, as shown in below image

- You can Preview GST Credit Note on Clicking Preview Button and Preview of GST Credit Note can be Exported in Multiple Extension and can also be Send as an Attachment File through Email as shown in below image

Thank You !

Comments

Post a Comment